Frequently Asked Questions

Frequently asked questions about International RBC Agreement for the Metals Sector.

1. What are the conditions to participate?

A company can participate if:

- it uses metals;

- it submits a short motivation explaining why it wants to participate and what it can contribute;

- there is no objection on the part of the other parties to the participation of the new company;

- it makes an annual financial contribution;

- it signs the following official documents:

- Agreement

- Confidentiality Protocol

- Assignment Agreement

2. How much does it cost to participate?

| Company size |

FTE |

Annual contribution |

| Micro |

0 – 25 |

€1.500 |

| Small |

26 – 250 |

€5.000 |

| Medium |

251 – 5.000 |

€10.000 |

| Large |

> 5.000 |

€20.000 |

3. What is expected of my company if I participate?

- Implementing due diligence in line with the OECD Guidelines and the UNGPs;

- Participation in one of the working groups:

- Working Group on Due Diligence

- Working Group on Collective Actions and Upscaling

- Working Group on Sustainable Secondary Materials Supply Chains;

- Collaboration with other participants in the agreement;

- Internal and external communication about the agreement and due diligence results.

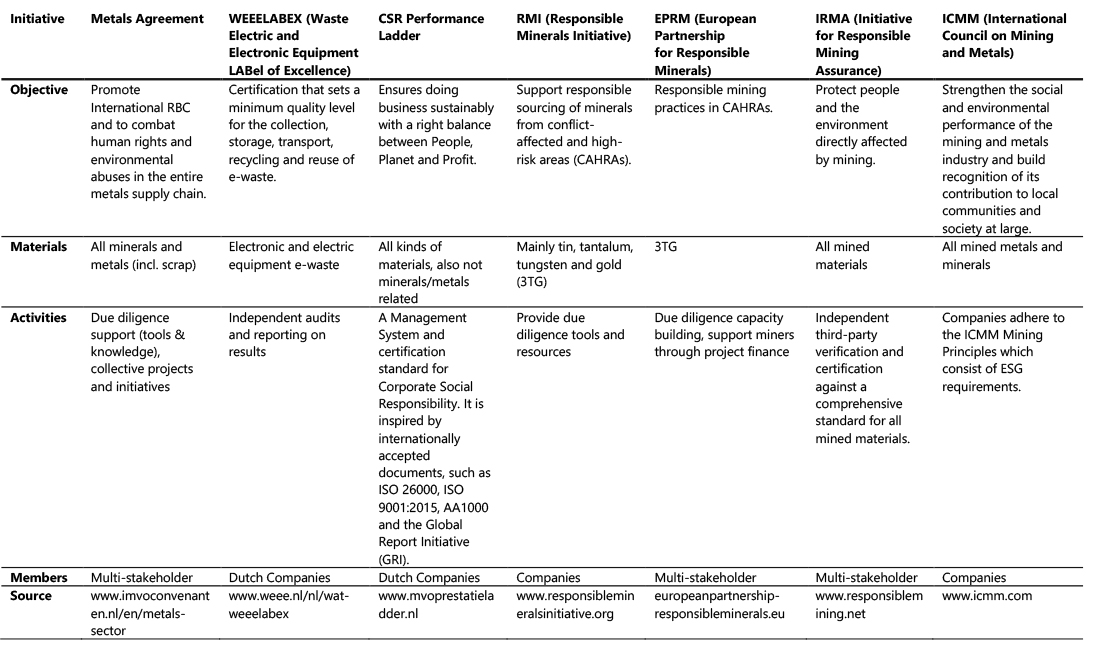

4. What is the difference between the agreement and other sustainability initiatives?

No.

Many companies use certification to mitigate social and/or environmental problems in their supply chain. Good, but it does not cover the full due diligence process. You could say that it can help in (partly) completing some of the due diligence steps. Certification can help you with the identification of certain risks and impacts (step 2), with the prevention and mitigation of the these risks (step 3) and the tracking of progress (step 4). The remaining steps are then still to covered in another way. Also, bear in mind that certification in most cases does not cover all applicable risks and impacts and does not cover all stages in the supply chain. Even if they do, be aware that certification does not always ‘find’ all risks and impacts and is not always able to successfully address them as many problems are too complicated to solve by certification alone.

So certification can be a one of the useful tools when doing due diligence but it cannot be the only tool being used.

5. How does due diligence work for recycling companies?

The context in which recycling companies operate, varies widely from those of companies that work with primary (mined) materials. While for primary metals holds that countries with increased risks to people or the environment are particularly at the supplier side (the origin of the materials, i.e. the mines), for recycled materials the destination countries that process the scrap metals are often the countries with increased probability of risks. The same goes for (lack of) transparency in value chains.

According to the OECD, risk-based due diligence involves a process of risk prioritisation based on the severity and likelihood of the identified risks. As the risks for some recycling companies seem more severe and/or likely at their customer chains, this could be an argument to address risks at this side of the value chain. However, the OECD Guidelines do not provide an exhaustive answer yet. As, at the same time, the Guidelines seem to focus mainly on supply chains, suppliers and the origin of the materials, rather than at the customers and destination of materials.

Recycling companies are in need of more clarity about their role and expectations when it comes to due diligence. The Agreement is therefore working on an tailor-made approach for recycling companies that meets the specific characteristics of the recycling sector.

Read this article to learn more about the link between circularity and IRBC (Dutch only).

6. What are the benefits if I participate?

There are multiple benefits to participation. These include improved internal business processes, improved morale in the workforce, decreased risk of supply chain disruption, and improvement of the public image as well as other positive effects. Additionally, the agreement will help companies in adhering to existing or upcoming due diligence legislation and provides the companies with access to a large network with expertise in the metals sector. Another advantage for companies that participate in the agreement is a reduction of costs, as the costs of due diligence tools and templates are shared between the parties.

7. Who is collecting and analysing the information provided by my company?

The independent secretariat of the agreement, housed at the Social and Economic Council of the Netherlands, will collect and analyse the data. In doing so it will adhere to the competition law and treat commercially sensitive data confidentially.

8. Do I need to share commercially sensitive information with other participants?

No. Sharing and exchanging of information between parties is done entirely in accordance with national and European law. In situations where the sharing of commercially sensitive information might be deemed necessary, companies will share the necessary information only with the independent Secretariat. The latter will anonymise and aggregate the information before sharing this with the other Parties.

9. Do I comply with international sustainability standards and legislation when I participate in the Agreement?

The Metals Agreement is based on the OECD Guidelines for Multinational Enterprises and UN Guiding Principles on Business and Human Rights. These are the most authoritative international standards in the area of human rights and environmental due diligence. They are also the basis for the European Union’s due diligence legislation which is currently in development.

10. How much time will I have to invest if I decide to participate?

That depends on the size, operations and individual choices of companies. Improving individual company due diligence practices is a continuous process and requires periodical review and evaluation by the companies. However, by gaining access to the tailor-made due diligence templates, tools and instruments offered by the agreement, companies save time and lower costs. Also, participating in the actual work of the agreement for individual companies is not time-consuming.

11. Why should I perform due diligence?

The Dutch government and other OECD member states expect companies to comply with the OECD Guidelines for responsible business conduct. While the OECD Guidelines are not binding, there is a due diligence legislation in several European countries. The European Union is also preparing due diligence law on EU-level. Due diligence requires investments form a company, but it will also benefit companies.

The Metals Agreement provides tools, templates and subject matter experts to support companies with the implementation of due diligence.

12. Am I responsible for risks around the world, even if I only do business in the Netherlands / Europe / OECD countries?

As described by the UNGPs, companies have the responsibility to respect human rights. The OECD Guidelines also refer to the responsibility companies have to do no harm to the environment. These responsibilities go beyond the operations of the company itself. Through its supply chains, a company can be connected to international RBC risks around the world, and is maybe not even aware of the risks present in its supply chains. It is therefore important to have good insight into your supply chains and engage with stakeholders or their representatives when making decisions that may affect them.

13. How can I make impact in the supply chain as a small or medium sized company?

For companies, especially for small and medium sized companies (SMEs) it is very difficult or even impossible to address supply chain risks on their own. The OECD also recognises this challenge, and encourages SMEs to collaborate at a (cross-) sectoral level as well as with relevant stakeholders throughout the due diligence process. Collaboration can help companies to gain access to a network with relevant knowledge, increase their influence on other supply chain actors, exchange best practices, and to save costs by sharing them with sector partners.

The Metals Agreement is a multi-stakeholder sectoral agreement and seeks to make due diligence for companies as efficient as possible. The more companies join the agreement, the greater the collective influence to make positive impact in the supply chain together.

15. What instruments does the agreement offer for implementing due diligence?

|

Instrument |

What is it? |

Why use it? |

|

Step 1: Policy and organisation |

||

|

Maturity Assessment |

Questionnaire on the performance of due diligence within a company. This is completed annually by the companies. |

1) Self-assessment for companies, to determine their level of implementing due diligence 2) Monitor progress in the implementation of due diligence |

|

Action plan |

An automatically generated document that extracts relevant information from the profile page, the Maturity Assessment questionnaire and the risk analysis. |

To formulate SMART objectives to improve the execution of due diligence within the company. |

|

Model international RBC policy |

Example text for international RBC / due diligence policy. |

Conducting due diligence starts with having a policy. This is also a requirement according to the OECD guidelines. |

|

Step 2: Risk Analysis |

||

|

Value chain analysis |

Companies indicate here who their suppliers / customers are, which materials they purchase and what the origin location is. |

Gain insight into the supply chain. This is the starting point for risk analysis. |

|

Resources page |

Overview of available instruments and information sources (paid and free) in the field of international RBC risks. This page is publicly available. |

Information provision to be able to perform risk analysis. |

|

Heat map |

Tool to prioritise identified risks in line with OECD guidelines (severity and likelihood). |

Gain insight into which risks need to be addressed first; the most severe risks in the supply chain. |

|

Step 3: Cease, prevent or mitigate risks |

||

|

Action plan |

An automatically generated document that extracts relevant information from the profile page, the Maturity Assessment questionnaire and the risk analysis. |

Preventing, mitigating or remedying potential or actual adverse impacts in the supply chain. |

|

Step 5: Communicate about due diligence |

||

|

Due diligence report template |

Template and checklist for drawing up a public report in the field of due diligence / international RBC. |

To make visible as a company how it respects people and the environment for stakeholders and contribute to improving transparency in the chain. Public reporting on, among other things, the approach to potential and actual adverse impacts is a requirement according to the OECD guidelines. |